Running a business in Ontario requires careful planning and protection. One aspect of this is securing the right business insurance policy. With numerous insurance providers available, finding the best quotes can seem daunting. That's where we come in.

We understand the unique needs of Ontario businesses and can help you research the complex world of business insurance. Our extensive network of reputable insurers allows us to provide a range of quotes tailored to your industry.

From professional indemnity, to technology coverage, we can help you select the coverage that best meets your requirements. Start by providing a brief summary of your business.

Our experienced team will then work with you to create a customized insurance plan that provides the assurance your business deserves. Don't wait - get started on securing your future today.

Oshawa Brokers: Your Go-To for Commercial Insurance Solutions

Whether you are a small business or a established company, securing the right commercial insurance is essential. At Oshawa Brokers, we understand the unique challenges of businesses in our community. Our team of experienced consultants is dedicated to providing personalized protection that fit your specific operations.

We offer a comprehensive portfolio of commercial insurance products, including: product liability, commercial auto, workers' compensation, and much more.

- We prioritize your needs

- Affordable coverage options

- Expert guidance every step of the way

Comprehending Commercial Insurance: Navigating Coverage Options in Ontario

For businesses operating in Ontario, securing the right commercial insurance coverage is paramount. It provides a safety net against unforeseen risks, shielding your assets and financial stability. With a wide range of coverage options available, it can be overwhelming to identify the suitable policy for your specific needs.

A comprehensive understanding of typical coverage types, such as fault insurance, real estate insurance, and income loss insurance, is essential. Consulting with an qualified insurance agent can help you explore these options and develop a policy that meets your unique demands.

- Think about the magnitude of your company.

- Analyze the potential risks your field exposes.

- Scrutinize your existing policies and identify any gaps.

Achieving Substantial Discounts on Business Insurance Premiums in Ontario

Navigating the world of business insurance in Ontario can often feel overwhelming. Costs are a considerable expense for many businesses, and finding ways to reduce these costs is crucial for success. Luckily, there are many strategies you can implement to uncover potential savings on your business insurance premiums.

- A key step is to perform a thorough assessment of your current coverage needs. Pinpoint any gaps in your existing policy and consider options for aggregating different types of coverage to achieve a more complete solution.

- Additionally, comparing quotes from various insurance providers is vital. Avoid simply sticking with your present provider – compare offers from several companies to confirm you're getting the best possible terms.

- Finally, consider ways to mitigate your liability. Implementing risk management strategies can decrease the likelihood of claims, which in turn can lead lower premiums.

Be aware that your business insurance needs can transform over time. Regularly assess your coverage and modify it as needed to accommodate any alterations in your business operations or risk profile.

Customizable Business Insurance Quotes for Ontario Companies

Ontario businesses face a spectrum of likely risks. To successfully navigate these challenges, it's vital to have the suitable business insurance coverage. Luckily, many insurance providers in Ontario now offer customizable quotes that cater the unique needs of each company.

Gaining a in-depth insurance quote requires a precise understanding of your business's operations. This includes elements like the type of industry you operate in, your annual revenue, and the hazards your business faces.

Once you have a solid grasp of these essentials, you can start to research different insurance companies. It's suggested that you receive quotes from at least three distinct providers to guarantee you are getting the most favorable possible rate.

Comparing Business Insurance Premium Quotes in Ontario

Navigating the complex world of business insurance can be daunting, especially when it comes to securing competitive quotes. In Ontario, where regulations and market dynamics are constantly evolving, it's crucial for entrepreneurs to diligently compare premium quotes from various insurance providers.

A comprehensive comparison process involves determining your specific Roughly Commercial Insurance in Ontario business needs and coverage requirements. Factors such as industry, revenue, possessions, and projected risks should be meticulously considered. Once you have a clear understanding of your insurance needs, one can begin soliciting quotes from reputable insurance companies in Ontario.

Be sure to provide accurate and comprehensive information about your business when requesting quotes. This will help ensure that you receive accurate premium estimates. Remember to carefully review each quote, paying close attention to the coverage offered, policy terms, exclusions, and customer support. Don't hesitate to contact to insurance providers with any questions you may have.

Edward Furlong Then & Now!

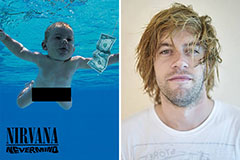

Edward Furlong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!